Empower the Future: Youth Savings Programs at TRUE Community Credit Union

Explore resources and educational materials designed to empower families and support the financial growth of young individuals.

Interested in opening a youth account?

Whether you're a young individual gearing up to kickstart your savings journey or a parent that wants to teach financial responsibility to your child, opting for a youth account is an excellent first step!

Check out information regarding our youth account, financial resources, and our Student Run Credit Unions.

{beginAccordion h2}

Youth Account Details

- Available to young savers up to age 18

- Teaches valuable saving habits

- Earns competitive dividends

- $5 minimum deposit to open

- No monthly service fee

- $5 minimum balance to maintain account

- Unlimited withdrawals and deposits

- Free Digital Banking

Apply now to open your account!

Apply Today

Check Out Our Youth Programs!

We help kids and teens thrive!

Learn about our student branches, scholarship opportunities, and more

Check out our Reality Fair Video!

Free Financial Resources

TRUE Community Credit Union is proud to partner with Banzai and GreenPath to provide a variety of free learning tools! With these tools, you can read topic-related articles, use different calculators, check out coaching sessions, and take courses on different financial topics.

Student-Run Credit Union school information!

As part of the Financial Education program, we offer youth the opportunity to volunteer or deposit their money within the student-run credit union at their school. It functions similarly to our other credit union branches; however, they focus more on deposits, occasional car payments, and periodic withdrawals. They are designed to serve students, teachers, and staff at participating schools.

TRUE Community Credit Union offers student-run credit union branches at many area schools, providing a unique, interactive way for students to learn about saving money and making good financial choices. To participate, students need to have a savings account with TRUE Community Credit Union.

Students with a Jackson $aves account can also use our student branches.

Check us out on Facebook!

It's amazing to look back and see that a program started in 1991 continues to thrive today. And all it took was a spark to get this fire going and it spread like wildfire.

In 1991, CP Federal Credit Union was approached by the Western School District to participate in a grant funded program that provided financial literacy to their students. This partnership launched a unique and robust student-run credit union program that provided students with real world work experience along with developing a savings habit.

We are pleased to offer Student run Credit Union branches in multiple schools. In 2021, we celebrated 30 years of providing financial literacy to area youth. That's pretty cool.

The student-run branches are operated by student volunteers who have completed an application, an interview, and the necessary training to run their school branch. Each branch has an Education Coordinator from TRUE Community on site to assist and oversee the operation.

Once the student volunteers have been selected and have been trained, we will open the student branch. This typically occurs in October or November. For our partner in education schools, K-2, we work with the administration to determine the best way to provide credit union to their students.

Our student volunteers learn important skills while working in their student credit union. Some of these skills include cash handling, member service, cooperation, organization, and even public speaking. The development of these life skills may help your child excel in their current academics while preparing them for their future career.

During the fall of each school year, our Education Coordinators present information regarding the student volunteer positions and provide applications in the grade level classrooms determined by the school.

{endAccordion h2}

Does your child have a youth account?

Below is a list of participating student-run branch locations.

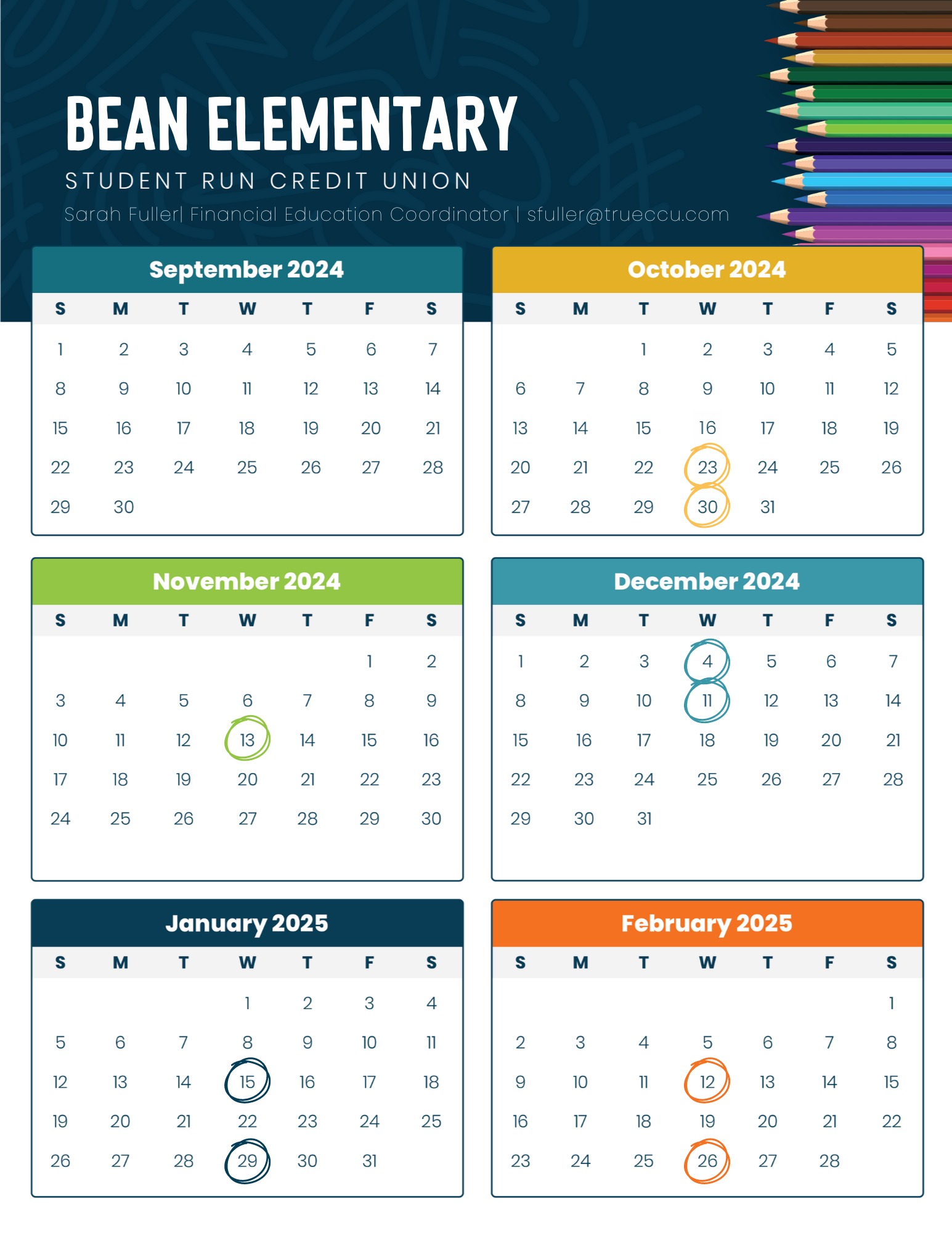

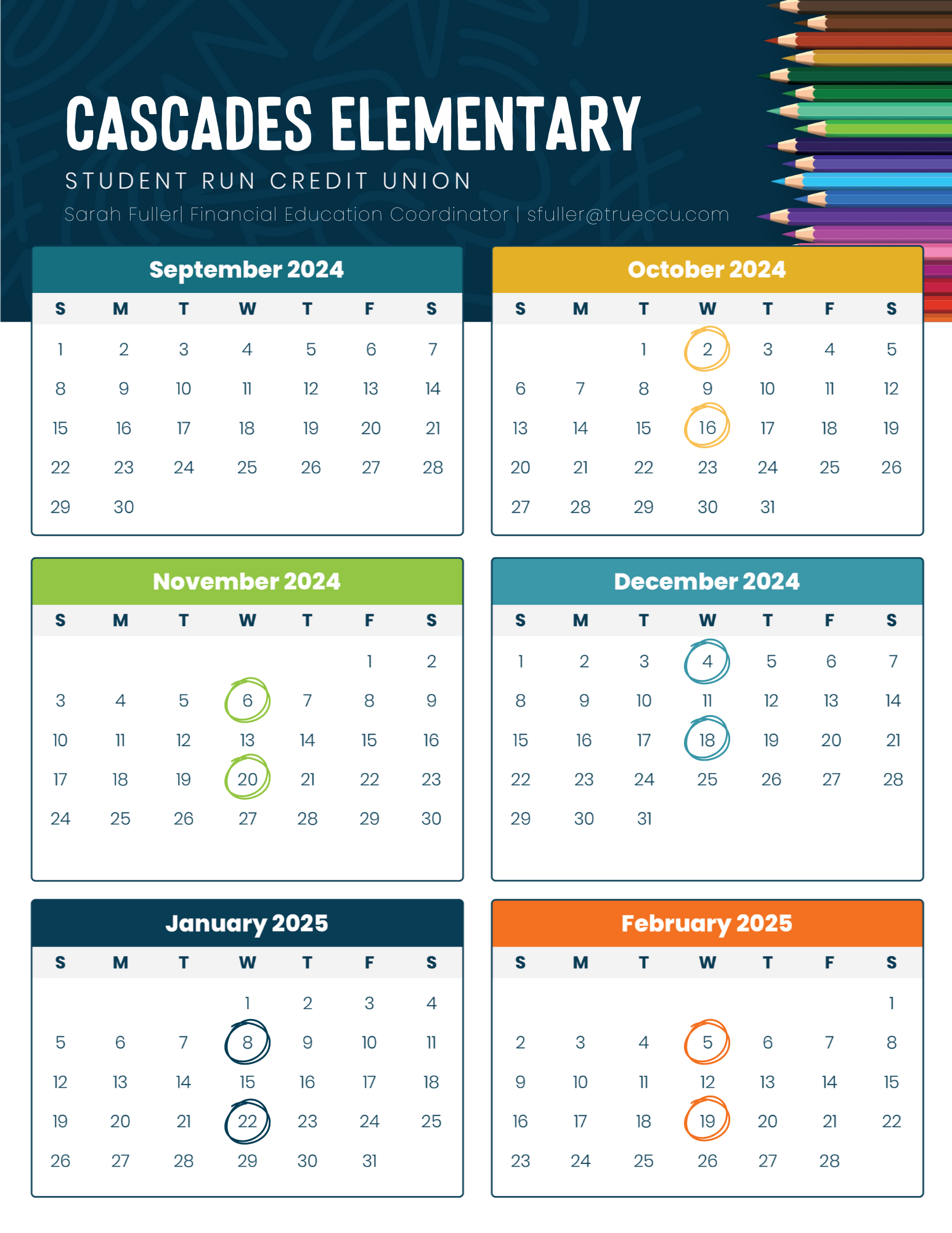

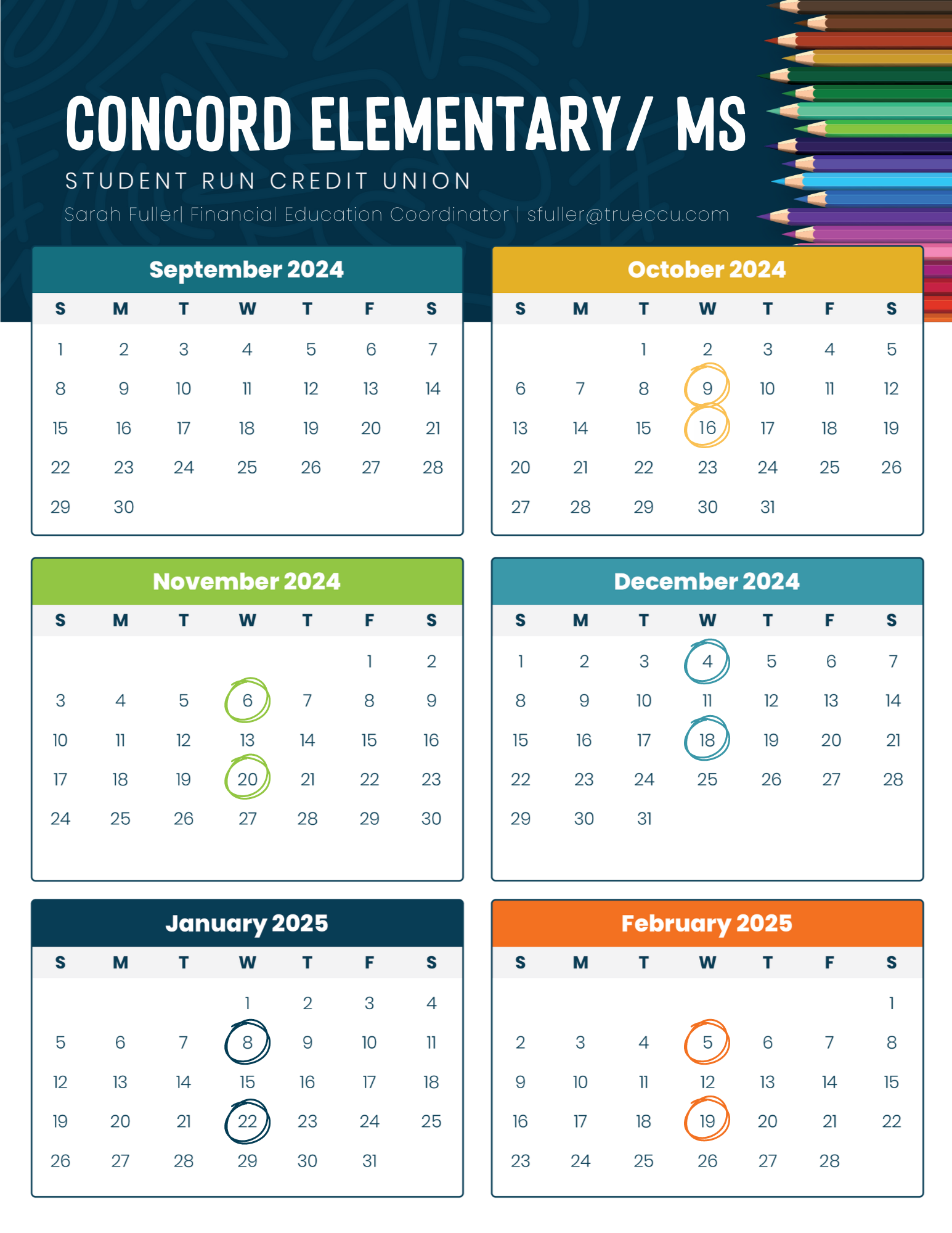

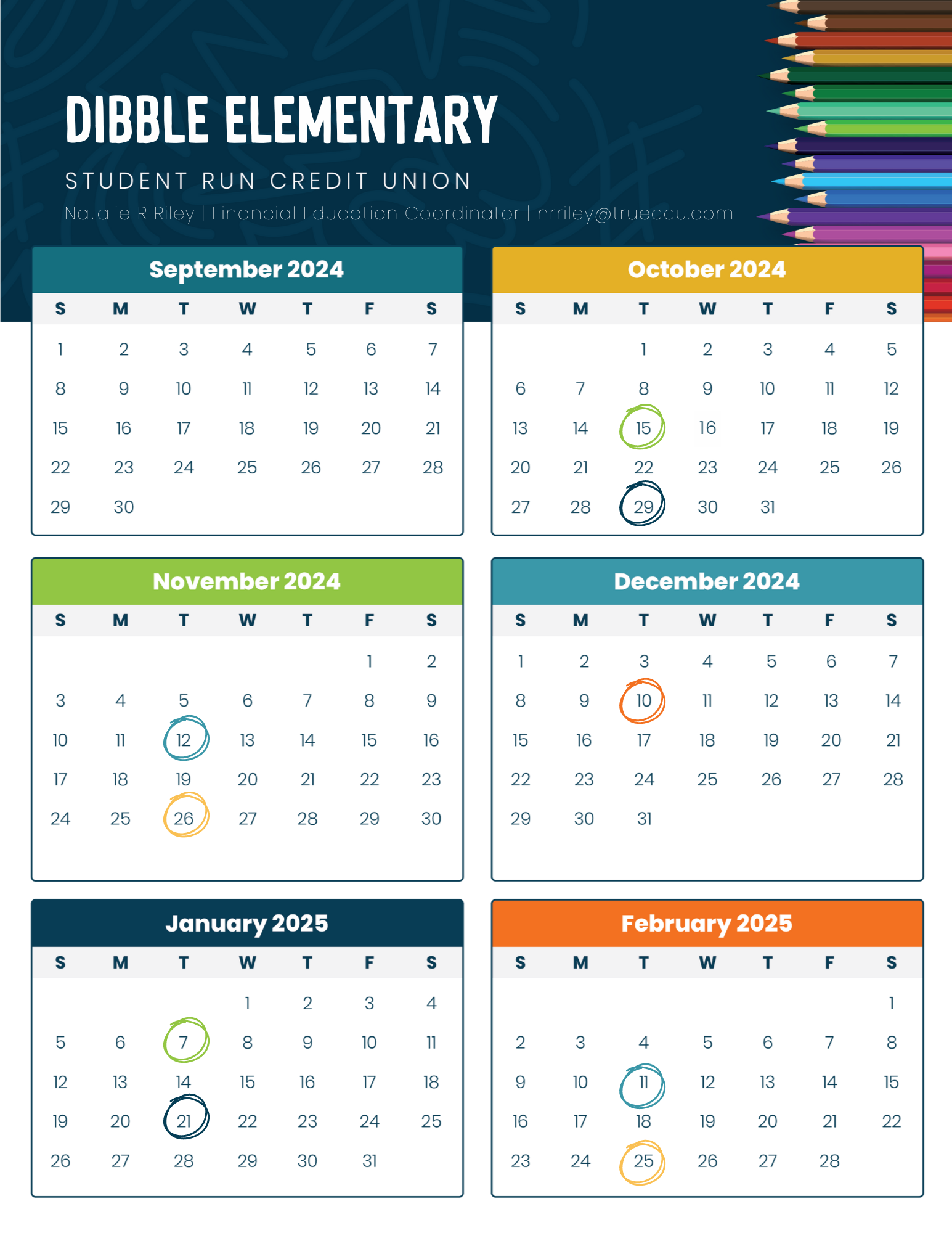

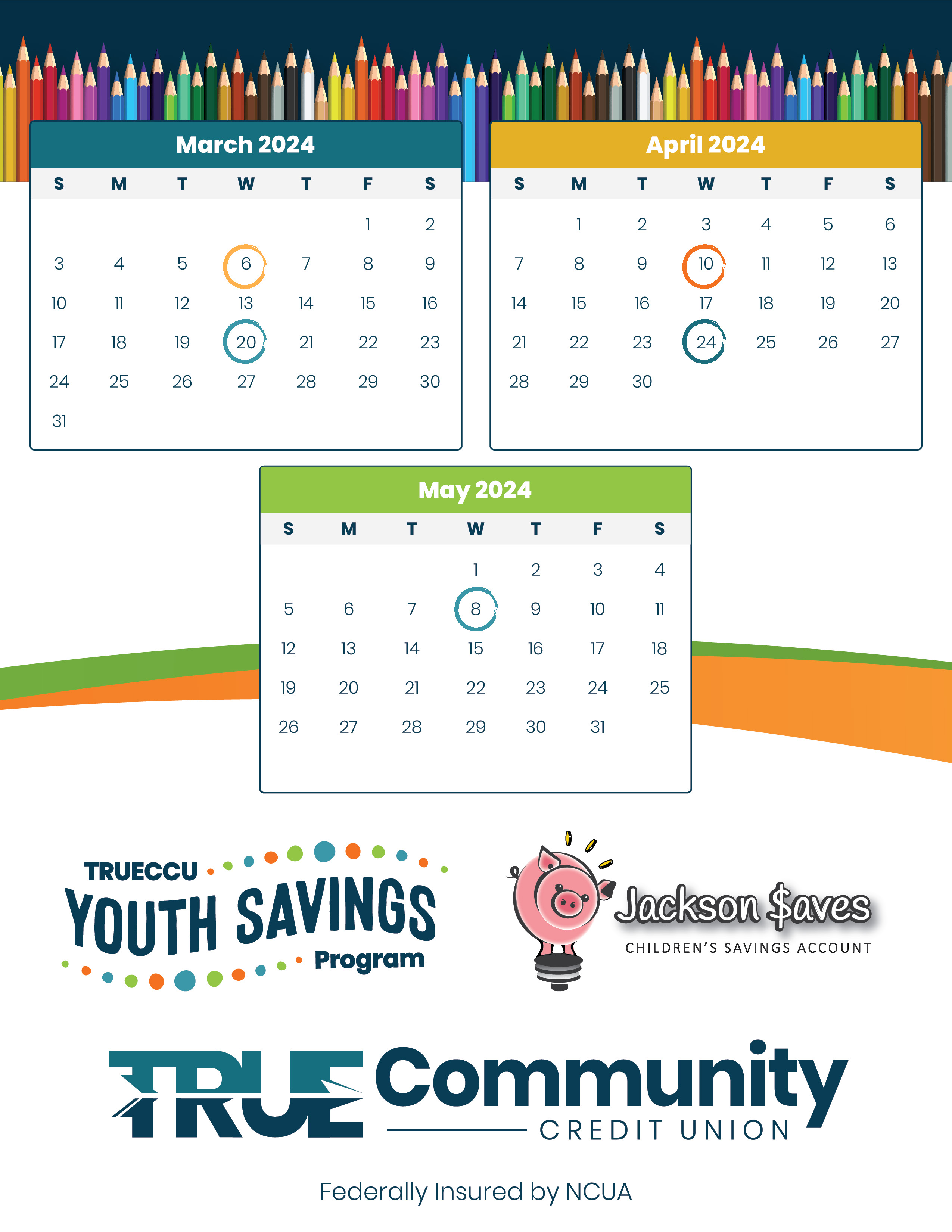

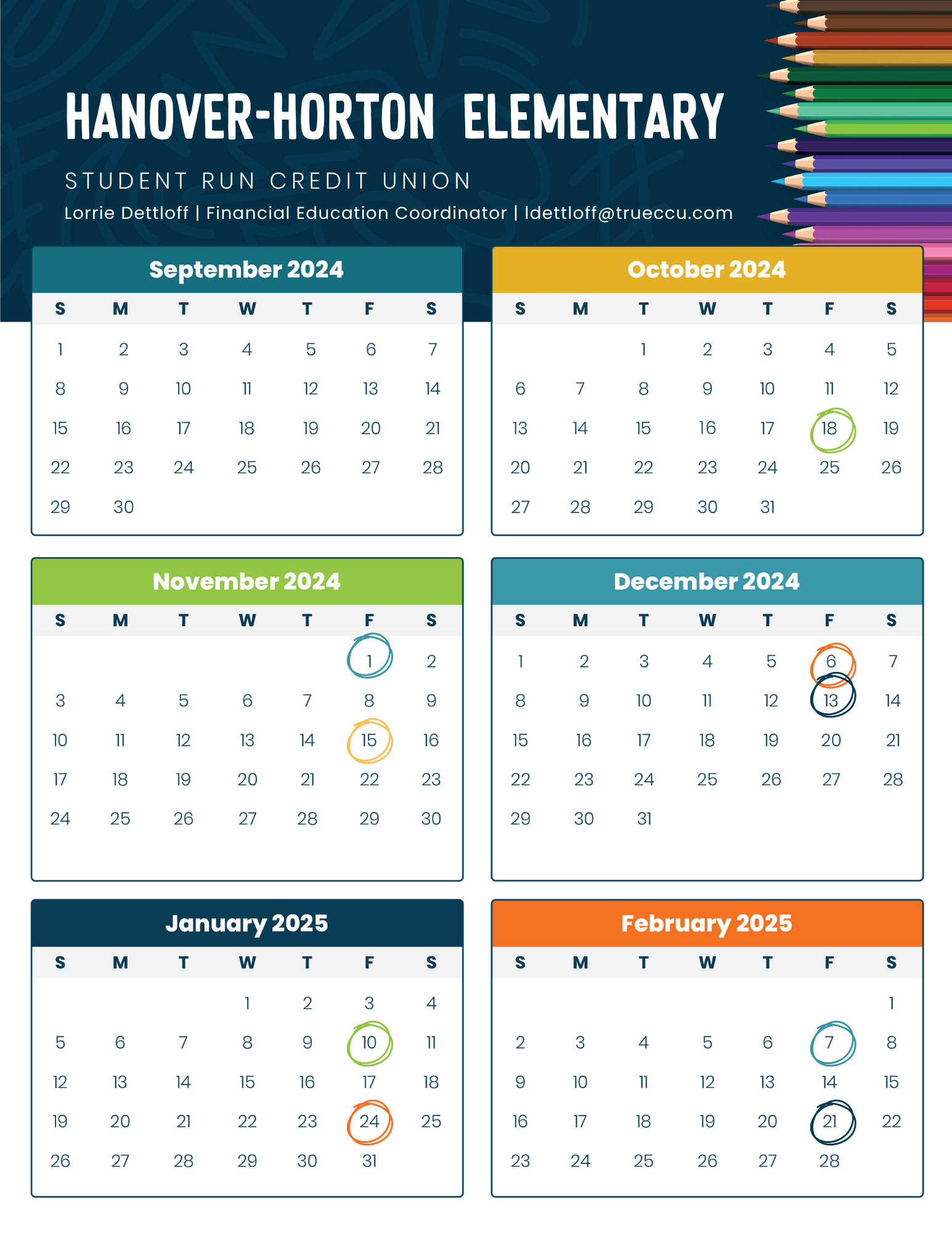

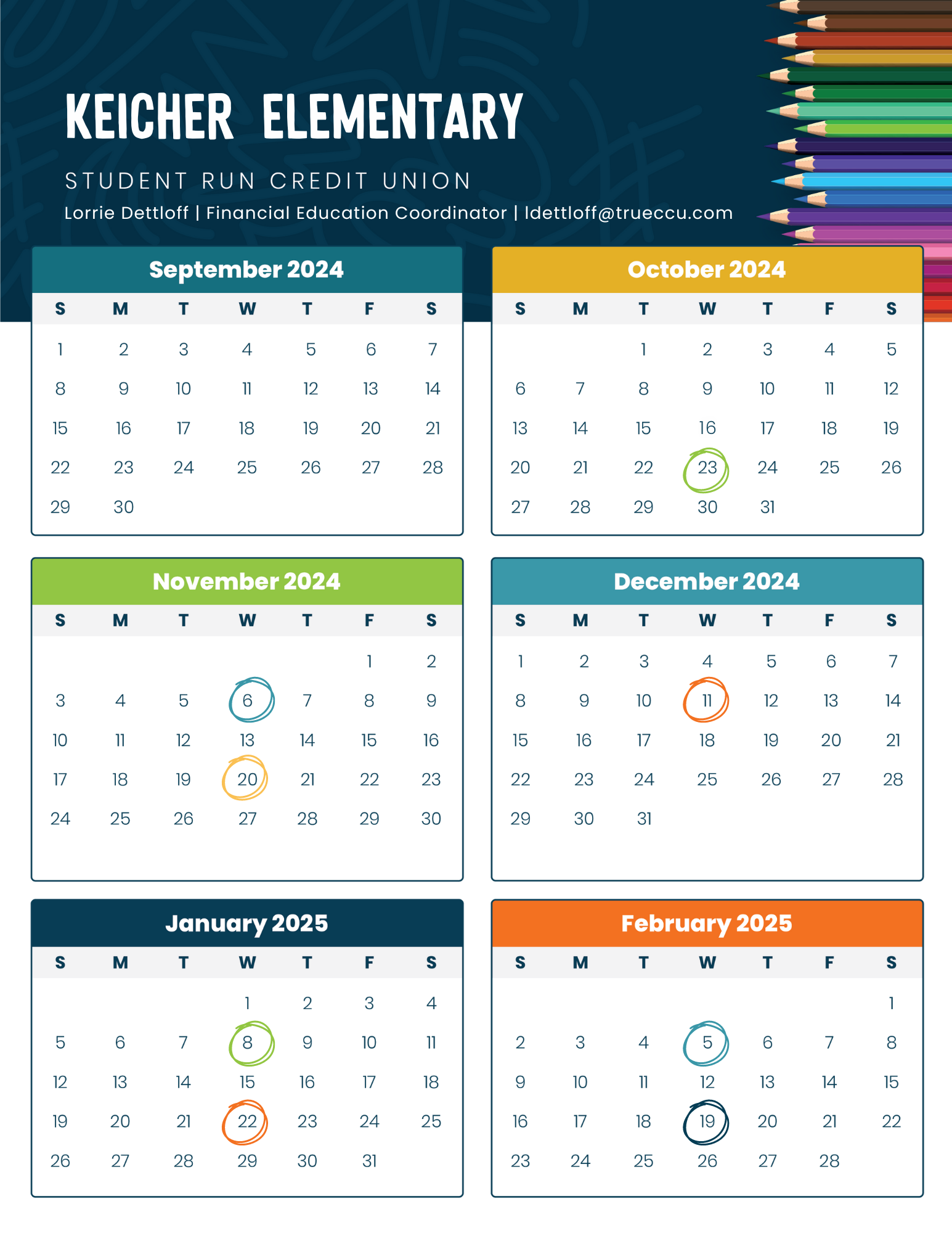

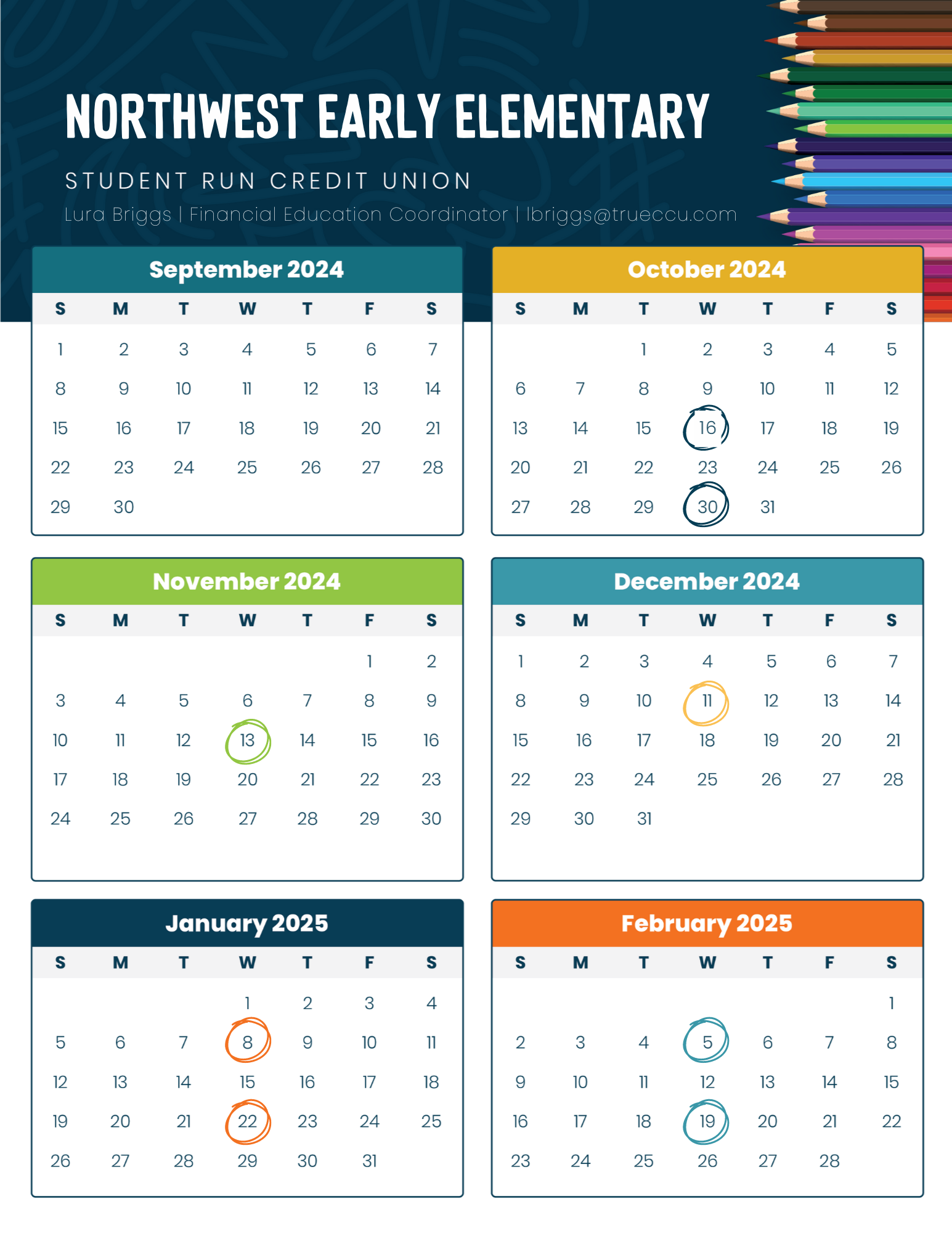

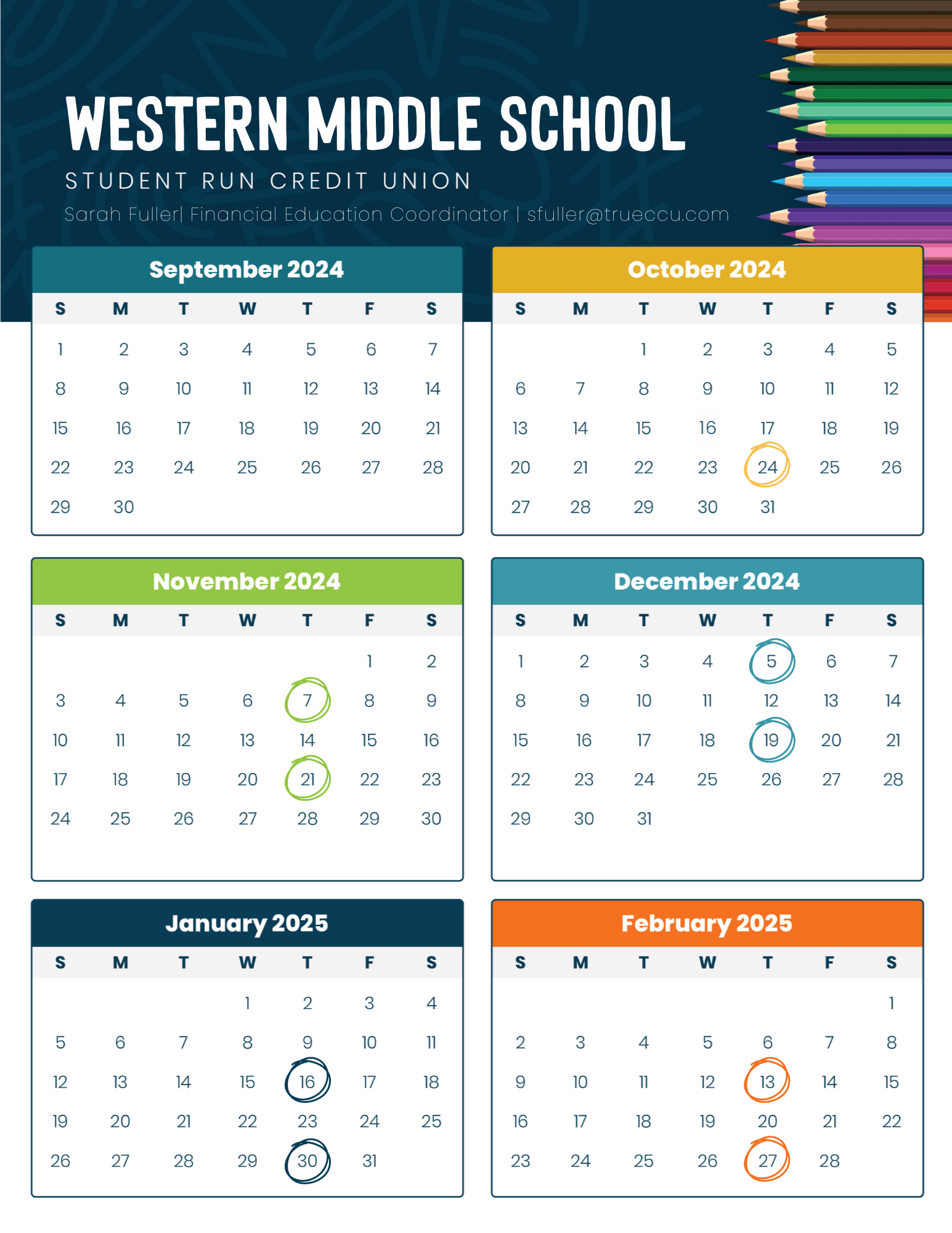

Each of our student-run credit union branches operate in the school two times a month unless the school has an inclement weather day, holiday, testing, or another event. Below is a list of our student-run branch locations.

Click on the school below to see when deposit days are scheduled.

Students can save a little as a penny, nickel, dime, or quarter each week at their Student Run Credit Union. (For the protection of our students, we encourage students with very large deposits to visit any one of TRUE Community Credit Union branch locations).

For each deposit made at their student run credit union branch, students will receive a punch on their punch card. On their fourth deposit, they can select a prize from our prize box. Student that forget their neck wallet and punch card are asked to hold onto their receipt and show it during their next visit to earn that missing punch.

Withdrawal Policy

In order to protect our elementary students, we ask that they bring a permission note for withdrawals larger than $5.00. The joint owner on the account should be the parent who grants permission to make the withdrawal by signing the note.

Students may choose to withdraw $5.00 or less without a note for book fairs, popcorn days, etc. If a student's account is dormant and wants to make a withdrawal from their account, we will require a note.

Our Financial Education Representatives do not bring cash to school since many of our students typically make deposits. The availability of funds will be based on the amount of deposits made that day. If your child needs to make a larger withdrawal, we encourage you to visit any of our branch locations.

Dormant Accounts

Accounts that haven't been used for one year will become dormant*, after three years of dormancy you will incur fees

*To keep your account active simply perform a transaction by making a deposit or a withdrawal each year.

Please make sure we have your most recent contact information for each of your accounts so we can notify you of any account updates or changes. If an account becomes dormant and remains dormant for three years, we are required to turn over the account to the state of Michigan. It remains your account and you will need to contact the state to obtain any remaining funds.

Each branch operates two times a month unless the school has a snow day, testing or another event. Above is a list of our student-run branch locations.

TRUE Community Credit Union, The best place to save and start a youth account!