Buckle up for your next adventure in Michigan — or beyond! We will help you get behind the wheel of a new or used vehicle.

Key Features

-

![]() Competitive Rates

Competitive Rates

-

![]() Fast Decisions

Fast Decisions

-

![]() Local Service and Processing

Local Service and Processing

- Competitively low rates for new or used vehicles

- Refinance vehicles financed elsewhere to potentially lower your rate

- Free pre-approvals for extra buying power when negotiating

- Indirect lending available on-site at a number of local dealerships

- Local decision-making and processing right here in Mid-Michigan

- Customized, friendly service from our experienced lending team

For added convenience, get a TRUE Community auto loan at the dealership! Indirect lending is available at the following local dealerships:

Albion

Hometown Chrysler Dodge Jeep Ram

Charlotte

Chelsea

Golling Chrysler Dodge Jeep Ram of Chelsea

Grand Ledge

Hillsdale

Jackson

Extreme Dodge Chrysler Jeep Ram

Lansing

Michigan Center

New Hudson

Saline

LaFontaine Chrysler Dodge Jeep Ram Saline

St Johns

Ypsilanti

It's often advisable to start looking for a vehicle loan before you start looking for cars.

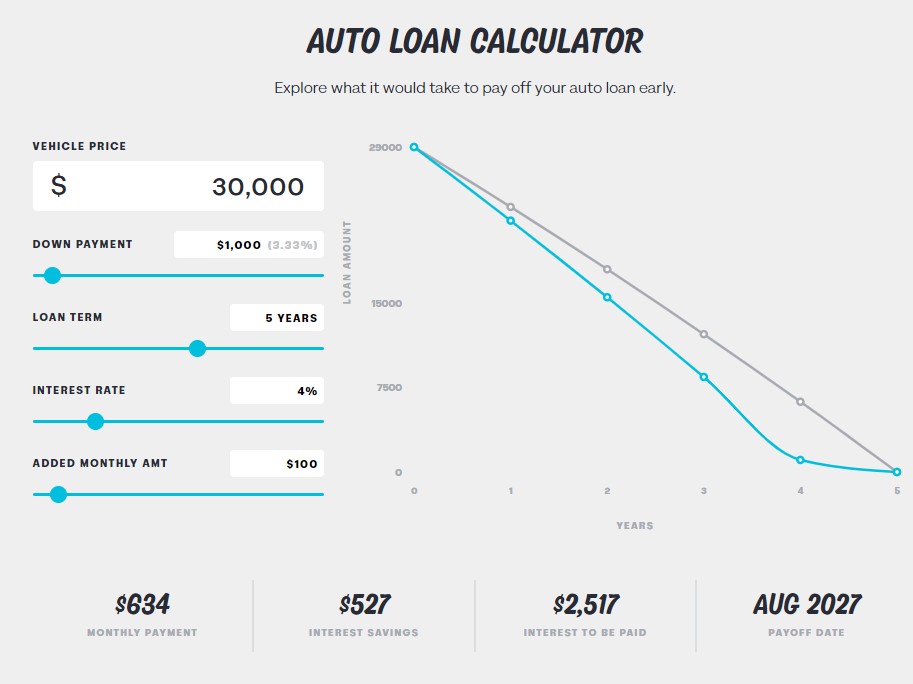

When you're looking for a vehicle loan, keep in mind that three factors determine the cost of borrowing:

An annual percentage rate (APR) for the financing charge

The period of the loan, or its duration

The principal, or the sum borrowed

Find out what a car loan will cost you

What a Car Loan Costs

Borrowers must be of legal age to apply for a loan.